19 Pro Tips: How To Stick To Your Budget

Today we are discussing how to stick to your budget. If you’ve ever wondered how to stick to a budget without feeling overwhelmed, you’re in the right place.

We’re diving into the budgeting world together. Whether you’re saving up for that dream vacation or trying to pay off student loans.

Or you just want to avoid the stress of running out of cash before payday. This blog post is your go-to guide for mastering the art of budgeting.

Let’s break it down into easy steps that you can start doing today to get your life back on track. Sticking to your budget is something that can really change your money life.

How To Stick To Your Budget

1. Create a Visual Budget Plan:

One powerful way to fortify your commitment to budgeting is by bringing your financial goals to life through a visual budget plan.

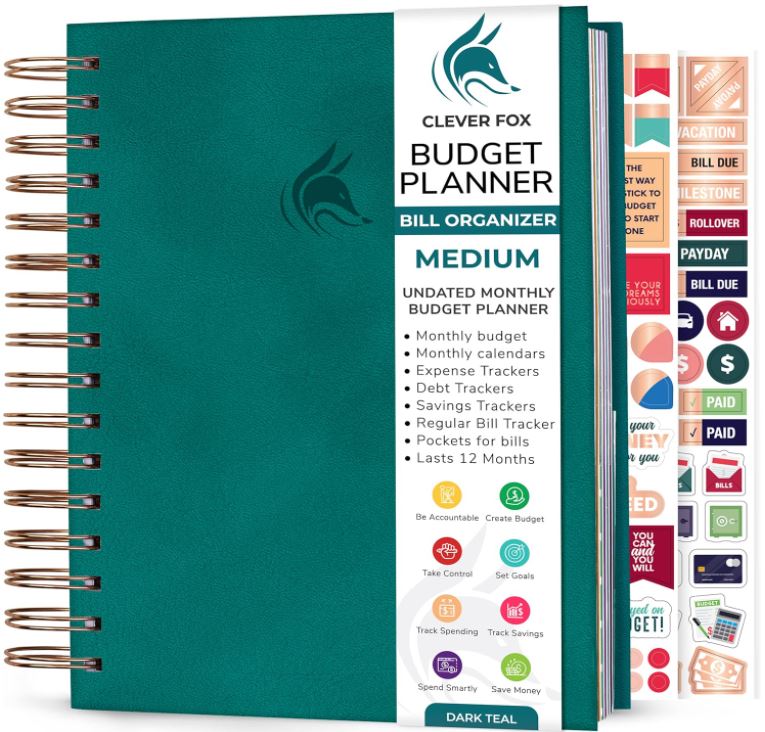

Designate a planner to map out your financial aspirations, from paying off debts to saving for a dream vacation. The Clever Fox budget planner is the one that I use as it has many features like budgeting and expense tracking.

Seeing these objectives regularly can provide a tangible reminder of why you’re budgeting in the first place, fostering motivation.

Break down your goals into smaller, manageable tasks and attach deadlines to them. The visual representation allows you to track your progress, celebrating the achievements along the way.

Another way to track your budget is to download budget trackers from Etsy sellers that you can use with Google sheets and Excel.

Resource: Best pay off debt planners

2. Use Cash Envelopes:

Use the cash envelope system. Allocate specific amounts of cash to various spending categories, placing them in labeled envelopes.

This method provides a clear and physical limit to your spending in each category, making it easier to resist the temptation to overspend.

When the envelope is empty, it serves as a visual cue that you’ve reached your limit for that category. Handling cash also makes the transaction more conscious, reinforcing the budgeting mindset.

Whether it’s groceries, entertainment, or dining out, the cash envelope system promotes a mindful approach to spending and enhances your overall financial discipline.

3. Set Short-Term Goals:

Breaking down larger financial goals into bite-sized, short-term targets is super helpful in the budgeting world.

Instead of focusing solely on distant objectives, identify smaller milestones that can be achieved within weeks or months.

This not only makes the journey more manageable but also provides a steady stream of accomplishments, boosting your confidence and motivation.

For instance, if you’re saving for a vacation, set monthly savings goals that contribute to the overall target. Each time you meet a goal, take a moment to acknowledge your progress and adjust your strategy as needed.

By integrating short-term goals into your budgeting plan, you transform the sometimes-daunting task of budgeting into a series of manageable steps, making financial success more achievable.

4. Automate Savings:

One of the most effective ways to fortify your savings strategy is by automating the process.

Set up automatic transfers from your checking account to your savings account shortly after each payday.

By making saving a non-negotiable part of your financial routine, you prioritize it over discretionary spending.

This approach ensures that a portion of your income goes directly into savings without requiring conscious effort, reducing the likelihood of diverting funds to unplanned expenses.

It’s a proactive way to build your financial safety net while reinforcing the habit of saving. Automating savings not only simplifies the process but also establishes a consistent and reliable path toward achieving your financial goals.

5. Unsubscribe from Tempting Emails:

Taming the inbox temptation is a crucial step in mastering budget discipline. Take control of your email subscriptions by unsubscribing from enticing promotional emails and sales alerts.

Retailers are experts at tempting you with limited-time offers and exclusive deals, and decluttering your inbox minimizes the impulse to make unnecessary purchases.

Unsubscribing doesn’t mean you can’t treat yourself occasionally, but it puts the control back in your hands, allowing you to make deliberate and considered choices about your spending.

By decluttering your digital space, you create a calmer environment that supports your budgeting goals and reduces the daily bombardment of spending temptations.

6. Meal Planning:

Meal planning is a budgeting superhero when it comes to controlling food expenses and minimizing waste.

By setting aside time each week to plan your meals, create a shopping list, and stick to it, you avoid the pitfalls of last-minute, unplanned grocery runs. Not only does this save you money, but it also encourages healthier eating habits.

Download a free meal planning printable

Planning your meals in advance allows you to buy ingredients in bulk, take advantage of sales, and reduce the temptation to dine out or order takeout on a whim.

As an additional benefit, it cuts down on food waste by ensuring you use all purchased ingredients before they expire.

Meal planning not only supports your budget but also contributes to a more organized and efficient kitchen, making it a win-win for your wallet and well-being.

7. Implement a “No-Spend” Day/Week/Month:

Designate specific periods for a “No-Spend” challenge, where you commit to refraining from non-essential purchases.

This exercise not only saves money but also encourages a reflective approach to spending.

During these periods, focus on enjoying activities that don’t involve spending, such as exploring nature, reading, or engaging in hobbies like watching crafting channels on Youtube.

It provides a reset button for your financial habits and reinforces the idea that not every day requires spending.

A “No-Spend” challenge is a powerful tool for recognizing and breaking the cycle of impulse purchases, helping you establish a more conscious and intentional relationship with your money.

8. Try the 30-Day Rule:

Before succumbing to the allure of a new purchase, adopt the 30-day rule. Delay immediate gratification by waiting for a month before making non-essential purchases.

This simple yet effective strategy gives you time to assess whether the item is a genuine need or just a passing want.

Many times, the initial excitement fades, and you realize you can live without the item, saving you money and preventing impulse buys.

The 30-day rule cultivates a habit of thoughtful and intentional spending, transforming your consumer mindset and reducing the likelihood of regrettable purchases.

By incorporating this waiting period, you gain better control over your impulses and make more informed decisions that align with your budgeting goals.

9. Explore DIY and Upcycling:

Dive into the world of Do-It-Yourself (DIY) projects and upcycling to not only save money but also unleash your creativity.

Instead of immediately buying new items, consider repurposing or refurbishing existing ones.

Whether it’s giving old furniture a fresh coat of paint or creating homemade gift tags, DIY projects can be both budget-friendly and personally rewarding.

Engaging in these activities not only reduces your reliance on expensive retail purchases but also promotes a sense of accomplishment.

We have a large section all focused on DIY and craft ideas that you can try when you need something to do instead of going out shopping.

The satisfaction of transforming something old into something new is not only great for your wallet but also for the environment.

Embracing a DIY and upcycling mindset adds a unique and personal touch to your surroundings while reinforcing the idea that creativity can thrive within budgetary constraints.

10. Negotiate Bills:

Regularly reviewing and negotiating bills is an often-overlooked strategy that can lead to significant savings.

Take the time to assess your recurring expenses, such as cable, internet, or insurance, and explore opportunities to negotiate better rates or switch to more cost-effective plans.

Many providers offer discounts or promotions to retain customers, and a simple phone call can make a noticeable difference in your monthly expenses.

Loyalty doesn’t always pay off in the world of bills, so be proactive in seeking out better deals.

By making bill negotiation a regular part of your financial routine, you ensure that you’re getting the best value for essential services, freeing up more funds to allocate toward your financial goals.

11. Reward Yourself (Mindfully):

Integrating rewards into your budgeting strategy can provide motivation and make the process more enjoyable.

However, it’s essential to approach rewards mindfully to prevent undermining your budgeting efforts. Instead of splurging on large, expensive treats, consider smaller, affordable rewards that does not cost money.

This could be a movie night at home, a favorite snack, or a relaxing evening with a good book.

By incorporating mindful rewards, you create a positive association with budgeting, reinforcing the idea that staying within your financial limits can lead to enjoyable moments.

It’s a balancing act that encourages responsible spending while recognizing and celebrating your financial achievements along the way.

12. Host a Clothing Swap:

Refreshing your wardrobe doesn’t have to come with a hefty price tag. Organize a clothing swap with friends or family, where everyone brings items they no longer need but are still in good condition.

This not only provides an opportunity to update your wardrobe without spending money but also fosters a sense of community.

Hosting a clothing swap is a sustainable and budget-friendly way to explore new styles while giving your pre-loved clothing a second life.

It’s a win-win for everyone involved, creating a social and eco-conscious approach to fashion that aligns with your budgeting goals.

13. Track and Analyze Spending:

Knowledge is power when it comes to budgeting, and tracking and analyzing your spending is a crucial aspect of financial awareness.

Utilize budgeting apps, spreadsheets, or even a simple pen-and-paper method to record your expenses. Categorize your spending to identify patterns and areas where adjustments can be made.

See our article about the best budget planners.

Regularly reviewing your spending habits provides valuable insights into your financial behavior, allowing you to make informed decisions about where to cut back or reallocate funds.

This hands-on approach to tracking and analyzing spending empowers you to take control of your financial destiny, turning budgeting from a passive exercise into an active and intentional practice.

14. Join a Budgeting Community:

The journey to financial success doesn’t have to be a solo mission. Consider joining a budgeting community, either online or in your local area, where like-minded individuals share tips, experiences, and support.

Engaging with a community provides a sense of accountability and encouragement, as you exchange ideas and learn from the successes and challenges of others.

Whether it’s discussing budgeting strategies, sharing frugal living tips, or celebrating financial milestones together, a community can be a valuable resource on your budgeting journey.

Surrounding yourself with individuals who understand your goals and challenges creates a supportive environment that reinforces your commitment to sticking to a budget.

15. Invest in Financial Education:

Elevate your budgeting game by investing time in expanding your financial education.

Understanding the principles of personal finance equips you with the knowledge and confidence to make informed decisions about your money.

Explore books, podcasts, online courses, or books that cover topics such as budgeting, investing, and debt management. The more you know, the better equipped you are to navigate the complexities of personal finance.

One of the best people to follow for great advice is Dave Ramsey. He has really good money saving books and a helpful YouTube channel.

By making financial education a priority, you not only enhance your budgeting skills but also gain a broader perspective on wealth-building strategies.

Investing in your financial knowledge is a long-term commitment that pays dividends by empowering you to make wise and informed financial choices.

16. Embrace the Cash-Only Challenge:

Take on the cash-only challenge. For a specified period, leave your cards at home and rely solely on physical cash for your transactions.

This approach adds a layer of consciousness to your spending, as you physically see the money leaving your hands.

It makes each purchase a deliberate and considered decision, reinforcing the importance of staying within your budget.

The cash-only challenge also helps break the habit of mindless card swiping and encourages a more mindful approach to daily expenses.

While it may require some adjustment, embracing the cash-only challenge can be a transformative experience that deepens your connection to your budget and enhances your overall financial mindfulness.

17. Implement the “One-In, One-Out” Rule:

Tackle clutter and curb excessive spending by adopting the “One-In, One-Out” rule. Before bringing a new item into your life, commit to parting with an existing possession.

This rule applies to various areas, from clothing and accessories to gadgets and household items.

By enforcing a one-for-one exchange, you not only keep your living space organized but also instill a sense of conscious consumption.

This rule encourages you to evaluate the value and necessity of each new acquisition, preventing impulse buys and promoting thoughtful consideration of your possessions.

As a result, the “One-In, One-Out” rule becomes a practical and sustainable approach to managing your belongings while maintaining a budget-friendly lifestyle.

18. Build an Emergency Fund:

Bolster your financial resilience by prioritizing the creation of an emergency fund.

This fund serves as a financial safety net, providing a buffer for unexpected expenses and helping you avoid dipping into your budget for emergencies.

Start by setting aside a small amount from each paycheck until you’ve built a fund that covers three to six months’ worth of living expenses.

Having an emergency fund not only safeguards you from unexpected financial setbacks but also reduces stress and anxiety related to unforeseen expenses.

It transforms your budget into a more robust and adaptable financial plan, allowing you to navigate life’s uncertainties with greater ease.

Building and maintaining an emergency fund is a foundational step toward achieving long-term financial stability and security.

19. Set Up Regular Budget Check-Ins:

Make staying on budget a habit by scheduling regular check-ins. Set aside some time each week or month to review your expenses, track your progress, and make any necessary adjustments.

These check-ins not only keep you accountable but also provide insights into your spending patterns. If you notice any deviations, you can address them promptly, ensuring that your budget remains a flexible and effective tool.

Consistent monitoring allows you to celebrate successes, identify areas for improvement, and stay proactive in your financial journey.

Regular budget check-ins turn budgeting into an ongoing, manageable process rather than a sporadic, overwhelming task.

Thanks for joining us on this budgeting adventure! We hope these tips make your financial journey a little less bumpy and a lot more rewarding.

Remember, budgeting is like having a superpower – it gives you the control to make your money work for you.

So, go out there, stick to your budget, and watch your financial goals turn from dreams into reality. Thanks for reading, and here’s to a budget-savvy future! 🚀💰